When operating a business, one of the things that most often gets neglected is a proper payroll management procedure. Once the business is small, the entrepreneur faces minimal risk of errors. However, the problem arises when the business scales up and the business hires more employees. Additionally, tax service in Toronto is the final resolution to all your needs.

In such circumstances, without a proper payroll management system, the business spends a lot of time working on each paycheck of employees, adjusting taxes, pension plans, insurance and more.

For starters, the Canada Revenue Agency (CRA) fines business billions of dollars for payroll errors. This can range from very simple mistakes to big ones, and you might get fined. This is one primary reason why we always encourage one to hire someone for accounting service in Toronto.

Moreover, the meaning of ‘overtime’ varies depending on your location. So, an employee working in Ontario might have different overtime limit than another employee working in Alberta.

For these reasons, more than 40% of small business owners state that bookkeeping and taxes are the worst part of owning a business, and these are certainly the most time-confusing. In fact, more than 18% of businesses outsource their payroll management tasks to specialized accounting firms in Canada. Tax service in Toronto is now a need of the hour.

Benefits of Implementing Proper Payroll Management System

Implementing a proper payroll management system maybe costly in the short-term, but it has huge benefits to a business long-term. Some of the benefits are as follows:

Improving the morale of employees

Having a well-planned payroll management helps the business to distribute the salary at the right time and reduces time consumption for calculation of tax, employment benefits and other costs. This means that the employers will avoid all the last-minute glitches and errors and employees will receive their salary at the same time every month. This keeps the employee’s morale high.

Reduction of fines through tax service in Toronto

Mismanagement of employee’s records might result in unrecorded taxes, which leads to hefty fines. Businesses most often pays huge amount of fines due to small errors which could easily be avoided using a payroll management system.

Structured tasks

Due to a planned payroll management system, all the tasks stay structured. This is why financial managers have to spend less time determining the employment benefits, taxes and more for each individual employee. Rather, they just input the amount of basic salary and the payroll is calculated on the basis of the basic salary.

Helps news startup owners

Having a preplanned payroll management system not only reduces time consumption, it also reduces a lot of stress. As a new startup owner, you don’t have to worry much about doing all of this on your own and risk manual errors. Rather, you can outsource the task to an established payroll management specialist in Canada like Infinity Finance & Investment Inc (IFII), and we can take care of the rest.

It can reduce overhead cost

Instead of hiring someone to calculate all the payroll manually, you can outsource your payroll tasks to experienced accounting firms. This will save you a lot of time and money, while you stay away from the hassle. Plus, you’ll have a better control over the finances of your business.

Implementing a Payroll Processing

If you’re willing to cut down the overhead expenses while increasing the efficiency during payroll, you must implement a strong payroll system. This might mean a loss of time during the initial stages of the payroll system, but you’ll get better at it as you spend more time into it.

So, what are the things that you must do in order to implement a payroll processing system?

Here are some simple steps that you can follow.

1. Preparing and Checking Important Details

At first, you must check all the employee details and ensure that all necessary information is correct and is being recorded. These include:

- Tax file number

- Full name and address

- Start date of employment

- Date of birth

- Bank account paid into

- Pay details such as gross wage, allowances, hourly rate, employment period

2. Communicate Expectations

Before you sign any contracts, make sure you have discussed your business’s payroll needs in-depth. This will help you to implement an appropriate solution that fits your business. Any sort of misunderstanding can result in delays and additional costs. This step is extremely important for tax service in Toronto.

3. Check Legal and Regulatory Compliance

Determine how the compliance process will be managed when the legal, taxation and payroll tax requirements change in the future. A simple compliance system will ensure that you spend minimal time adjusting the payroll system.

4. Standardize The Pay Policies

Review all of your payment policies and procedures to ensure that there are no inconsistent applications or outdated/inefficient workflow patterns. For example, shift differentials included in overtime calculations in one department but not another.

5. Develop Realistic Schedules

At first, you must work with your payroll provider to develop a flexible but realistic schedule for implementing your new payroll system. Aim to implement at the start of the year or in the first quarter to ensure that there’s plenty of time before the end of the financial year to familiarise yourself with any new processes.

6. Synchronize All The Integrated Systems

In general, there are one or more systems that will need to be integrated within your new payroll system. Time and attendance, scheduling and accounting software are some examples.

7. Provide Proper Training

Determine who will be running the payroll system, and provide extensive training. This mainly applies when you create in-house payroll software as opposed to an outsourced payroll solution.

8. Testing the System

Before rolling the software out, you should thoroughly test every aspect of the new system to ensure data is accurate, payrolls are processed accurately and that the system does improve operational efficiency.

9. Communicating with Employees

While you’re implementing the new payroll system, you must remember to maintain regular and consistent communication with your staff. They’ll be the key determinants to how well your new payroll system functions and they’ll provide you with feedback on how to improve the system.

10. Justification & Reviewing

Make sure that you continually review how the new payroll management system is performing. You can let people calculate their pay, and then match it with the system to check for accuracy. If you find that the system is inaccurate, make sure you fix the issue as soon as possible!

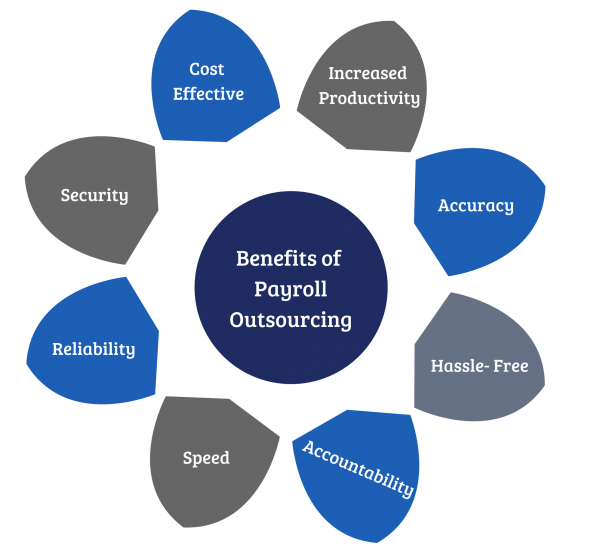

Why You Should Outsource Your Payroll Management System

Up until now, we’ve seen why a proper Payroll Management System is necessary and how you can implement a payroll management system in your company. But, let’s be serious, implementing such a system is a complicated task. There are a lot of aspects that you must consider, and you very little scope of error.

One simple error might mean another hefty fine for your business; you wouldn’t want that. Moreover, as you’re just starting out fresh you’re subjected to human errors that might occur.

That’s why you should outsource your payroll management system tasks to a professional accounting firm with years’ worth of experience working with these systems. Financial advisors recommend you to review the vendors and not worry much about the price; because, experience comes at a price! Financial planning in Toronto is no more a thing to worry about. We at IFII are ready to help you accomplish your financial goals.

Not only does these eliminate the chance of human errors, but also helps in enhancing the accuracy of the payroll service.

The Bottom Line

Payroll management is one of the integral parts of your business, and you ought to do it right. For businesses, it not only helps maintain the paycheck of employees, adjusting taxes, pension plans, insurance and more. A proper payroll system not only makes it easier, but also automates the process. This reduces the time required to do these tasks.

If you’re looking for an effective payroll service, you can surely trust Infinity Finance & Investment Inc. to take care of all your payroll management tasks. We’re one of the best accounting firms in Canada, and we’ve served more than a hundred clients all over in Canada for over a decade.

With such massive experience, we ensure utmost perfection in our payroll management service with minimal worries of mistake. You can contact us to get a custom quote for your business! We offer the best accounting service in Scarborough. Please visit our website to learn more about how we can help you with tax service in Toronto!